BTC Price Prediction: Navigating the $110,500 Pivot Point

#BTC

- Technical Positioning: BTC testing lower Bollinger Band with MACD still bullish suggests potential reversal opportunity

- Institutional Support: $3 billion accumulation plan and growing ETF adoption provide strong fundamental backing

- Critical Levels: $110,500 breakdown could shift momentum, while holding above maintains bullish structure

BTC Price Prediction

Technical Analysis: BTC Shows Mixed Signals Near Critical Levels

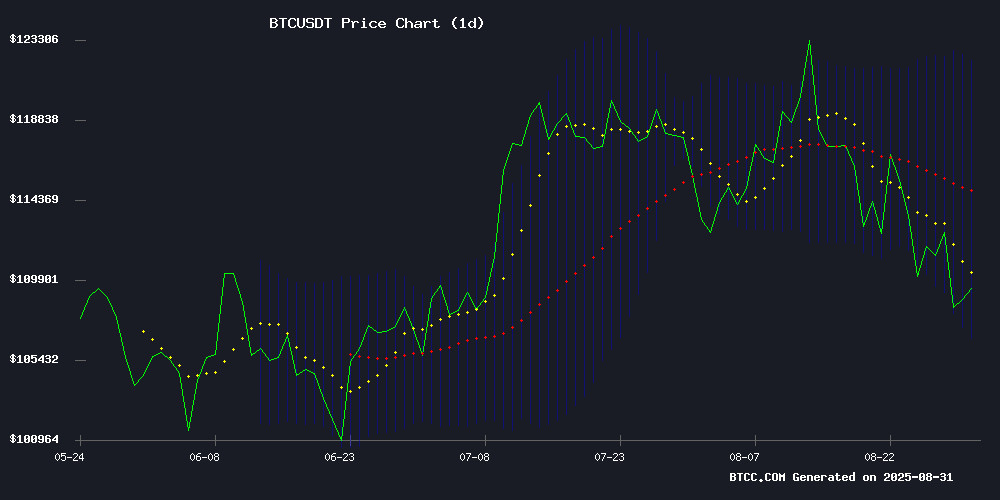

According to BTCC financial analyst Michael, Bitcoin's current price of $109,431 sits below the 20-day moving average of $114,397, indicating potential short-term weakness. The MACD reading of 4,311 suggests bullish momentum remains intact, though the price is testing the lower Bollinger Band at $106,622. A break below this support could trigger further downside toward $105,000, while holding above $110,500 may reignite the push toward $120,000.

Market Sentiment: Institutional Confidence Meets Technical Caution

BTCC financial analyst Michael notes that while institutional accumulation plans and ETF growth provide long-term bullish fundamentals, recent headlines signal near-term caution. The combination of Google Trends signaling a local top and price testing key support at $108,000 creates a mixed sentiment environment. Michael suggests that the $3 billion accumulation plan from Japanese firm Convano and Bitcoin ETFs approaching gold ETF AUM levels provide structural support, but traders should monitor the $110,500 level closely for momentum shifts.

Factors Influencing BTC's Price

Bitcoin Daily Close Spurs Caution – $110,500 Breakdown Could Shift Momentum

Bitcoin's daily technical outlook turned bearish as the cryptocurrency closed below the critical $110,500 support level. Analysts warn that a sustained breakdown could pave the way for a test of $100,000, though a swift recovery would negate the bearish signal.

Market observers note weakening Bitcoin Dominance (BTC.D), often a precursor to altcoin rallies. Capital rotation into alternative assets may gain momentum if BTC fails to reclaim key levels during the monthly transition period.

Bitcoin's Path to $120K Hinges on Key Support Levels Amid Institutional Confidence

Bitcoin's potential rebound to $120,000 is under scrutiny as it tests critical support levels. Trading at $108,450, BTC finds itself at a pivotal juncture, with the $104,700 Fibonacci retracement level acting as a historical floor. A bounce from this zone could propel prices toward $112,000 and ultimately $120,000–$123,000.

Institutional confidence in bitcoin has grown steadily since mid-2025, with annualized volatility plummeting to record lows near 30%. JPMorgan underscores BTC's undervaluation relative to gold, framing it as a macro hedge rather than a speculative asset. The MVRV Ratio at 2.1 and shrinking exchange reserves alongside steady ETF inflows further validate this thesis.

Market signals suggest weakening downside pressure, with the Relative Strength Index hovering NEAR 37. However, failure to hold $104,000 could trigger a correction toward $100,000. The $104,000–$108,000 range now serves as the battleground for Bitcoin's near-term trajectory.

Hollywood Thriller 'Killing Satoshi' To Explore Bitcoin Mysteries

A major Hollywood production, 'Killing Satoshi,' is set to delve into the enigmatic origins of Bitcoin and its creator, Satoshi Nakamoto. Directed by Doug Liman and written by Nick Schenk, the film stars Casey Affleck and Pete Davidson. Production begins in London this October, with a 2026 release date.

The plot revolves around a group confronting a powerful coalition of governments, financial institutions, and tech firms intent on suppressing Nakamoto's identity. The film's tone draws inspiration from 'The Social Network,' using Bitcoin's genesis to examine the societal impact of disruptive technology.

Central to the narrative is the mystery of Nakamoto's estimated 1.1 million unmoved bitcoin, valued at over $120 billion. Blockchain analysis suggests these coins were mined in Bitcoin's earliest days, yet their dormant status fuels speculation about lost or destroyed private keys.

Japanese Nail Salon Operator Convano Unveils $3 Billion Bitcoin Accumulation Plan

Tokyo-listed Convano has launched an aggressive Bitcoin acquisition strategy targeting 21,000 BTC (0.1% of total supply) by March 2027. The nail salon company plans to raise ¥434 billion ($3 billion) through a three-phase accumulation plan, aiming for 2,000 BTC by 2025-end and 10,000 BTC by August 2026.

Director Taiyo Azuma framed the move as a hedge against yen weakness and Japan's economic pressures. "Our goal is clear - to become one of the world's leading corporate Bitcoin holders," stated Azuma in a Bloomberg interview. The strategy positions Convano alongside MicroStrategy and Tesla in institutional BTC adoption.

Historic Flip: Bitcoin ETFs On Pace To Surpass Gold ETFs In AUM

Bitcoin Exchange-Traded Funds (ETFs) are nearing a watershed moment in global finance. With assets under management (AUM) doubling to $150 billion over the past year, they are closing in on gold ETFs, which stand at $180 billion. Just three years ago, gold ETFs dwarfed their crypto counterparts by a factor of five. The gap is now collapsing at unprecedented speed.

Institutional adoption is driving this seismic shift. BlackRock, the world's largest asset manager, has emerged as a key player in the space. Bitcoin ETFs are no longer niche instruments but mainstream portfolio staples, mirroring crypto's journey from speculative asset to institutional darling.

The crossover could occur as early as 2025 if current inflows persist. This isn't merely a statistical milestone—it's a symbolic passing of the torch from traditional SAFE havens to digital asset innovation.

Crypto Market Plunges as Google Trends Signal Local Top

The cryptocurrency market faced intense bearish pressure beginning August 28, with major assets hitting new lows by August 29. Bitcoin, the leading digital asset by market capitalization, dropped to $107,850—a stark indicator of the sector's volatility.

Analysts point to Google search trends as a predictive tool for this downturn. João Wedson, founder of Alphractal, noted a surge in crypto-related queries on Google, suggesting heightened retail interest often precedes market tops. The Google Trends chart reveals spikes in searches for 'Bitcoin,' 'altcoins,' and 'centralized exchanges,' mirroring past patterns before corrections.

While some interpret this as a bull cycle peak, others see it as a temporary retracement. The data underscores the market's sensitivity to retail sentiment, with search activity serving as a contrarian indicator.

Bitcoin's Retreat to $108K Tests Bullish Resolve Amid Diverging Market Signals

Bitcoin's 13% pullback from its $124K peak has reignited debates about the sustainability of its bull run. The cryptocurrency breached the $110K support level on 29th August, now testing critical defense at $108K—a threshold analyst Ali Martinez identifies as make-or-break for the bullish thesis. Failure to hold risks a deeper correction toward $70K, mirroring the 2021 cycle's trajectory.

Macro Optimism clashes with technical warnings. While July's inflation data triggered cross-asset selloffs, Bitcoin's drop remains within historical bull market retracement bounds. The RSI divergence and MVRV Momentum indicator patterns observed by Martinez echo those preceding previous cycle tops, injecting caution into the rally narrative.

On-chain metrics and the looming September rate cut decision now dominate trader focus. The market's ability to absorb this volatility—while maintaining key support levels—will determine whether the $100K danger zone becomes a consolidation pitstop or a reversal point.

IREN Limited Settles $20M Dispute with NYDIG Over Bitcoin Mining Loans

IREN Limited has agreed to pay $20 million to NYDIG to resolve a protracted dispute tied to defaulted Bitcoin mining equipment loans. The settlement, initially drafted in August but kept confidential, stems from 2021 financing arrangements for two special-purpose vehicles that collapsed during 2022's crypto market downturn.

The resolution covers litigation in Canada and Australia while shielding IREN's affiliates and executives from further claims. Notably, $18.2 million of the settlement exceeds prior reserves—a rare outcome in an industry where such disputes typically trigger bankruptcies or fire sales.

The deal coincides with IREN's strongest quarterly performance to date, including $187.3 million in revenue last quarter. Market observers note the settlement removes a key overhang as Bitcoin mining operations stabilize following last year's profitability crisis.

BTC Crash or Golden Chance? Inside the Latest Bitcoin Bloodbath

Bitcoin's price action paints a grim picture for holders as the cryptocurrency tumbles to $108,600, marking a 1.92% decline over the past 24 hours. Market sentiment appears shaken, with traders weighing whether this represents a buying opportunity or the start of a deeper correction.

The sell-off comes amid broader crypto market weakness, though Bitcoin remains the focal point. CoinMarketCap data confirms the downward momentum, with no immediate catalysts visible to reverse the trend. Such volatility underscores the asset class's speculative nature.

Is BTC a good investment?

Based on current technical and fundamental analysis, Bitcoin presents both opportunities and risks for investors. The current price consolidation around $109,431 offers a potential entry point for long-term believers, though short-term volatility may continue.

| Metric | Current Value | Signal |

|---|---|---|

| Price vs 20-day MA | -4.3% below | Caution |

| MACD | 4,311 (Bullish) | Positive |

| Bollinger Position | Near Lower Band | Oversold |

| Key Support | $106,622 | Critical |

| Institutional Flow | Strong (ETFs + $3B plan) | Very Positive |

Michael suggests dollar-cost averaging for new positions and setting stop-losses below $106,000 for risk management.